INTRODUCTION

Pngme platform, as a new marketplace lending/borrowing platform is obviously an improvement on the already-existing or current Marketplace lending platforms.

MARKETPLACE LENDING platforms are financial institutions that are non-bank that links lenders with borrowers at a small charge (fee). Marketplace lending has been growing rapidly since the financial crisis that occurred 11 years ago, an event which have made investors or lenders to be seeking out greater returns on their capital investments than what they should normally seek. Marketplace lending was initially a simple peer-peer structure, but is now being 'controlled', so to say, by well-established investors and technical funds who purchase loans directly from some lending platforms. The lending markets are being faced with a couple of problems, today, which have been arising since the inception of Marketplace Lending.

PROBLEMS OF MARKETPLACE MARKETPLACE LENDING

Limitations involving decentralized loans: Access to decentralized loan marketplaces have been bounded or restricted. These marketplace serve Microfinance Institutions (MFIs); Digital Asset Hedge Funds; Micro, Small and Medium Scale Enterprises (MSMEs and Mobile Money Networks (MMNs).

Counterproductive Credit Models: Loan rates set by present marketplace lenders are set with ineffectual credit models. This means that loans given may either underperform or over-perform their risk information.

High lending rates: Some borrowers who have no formal credit history may be faced with no option when searching for a lender and may get lenders who give high lending rates.

High management costs: MFIs charge their customers with high interest rates, as a result of high management costs. The high cost is due to their use of ineffectual Credit-scoring Models, high resource-based management procedures.

Investors' high demand for profit: Investors are seriously and desperately craving high returns. As earlier mentioned, this has been a constant issue since 2008. Investors are now looking for other options for earning greater returns on their investments.

PNGME's SOLUTIONS AND WHY PNGME WILL SUCCEED IN EMERGING MARKETS!

The Pngme Platform is designed, and structured in order to solve the current problems of the Marketplace lending platforms and make the lending markets experience a significant turnaround.

With the introduction of the following:

- Block-chain technology

- Smart contracts

- Matching algorithms

- Risk assessment and credit-scoring

- Risk metadata

- Collateralized loans

- Digital bonds sales

- Mobile App and so on...

Pngme is able to provide solutions to the above problems.

Pngme links MSMEs with easily accessible, cheap credit through various technologies. Lenders are made to understand how the digital bonds work on the platform, as well as matters concerning risk.

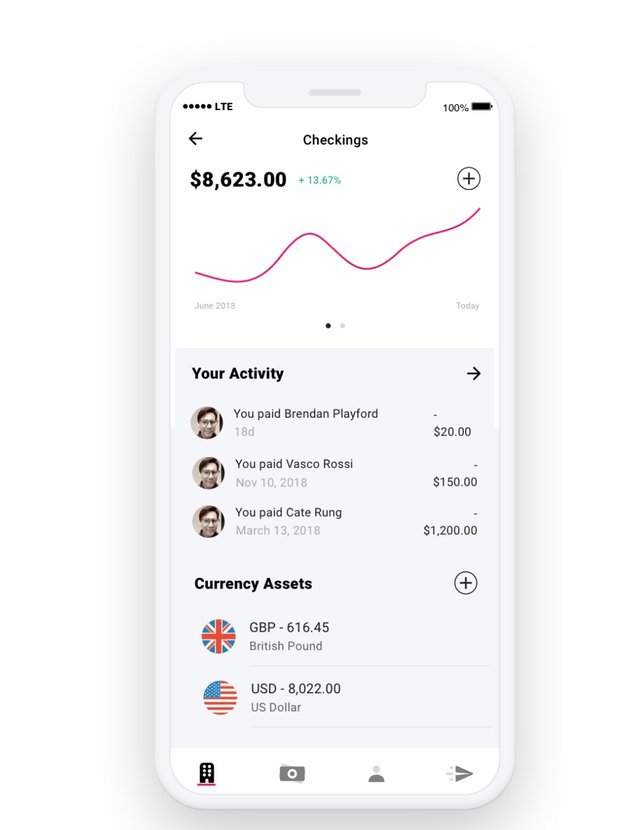

Pngme is a competitive platform,that gives access to digital-asset-based capital markets for Mobile Money Networks, MSMEs, and Digital Hedge Funds.

Loans that are sold as digital bonds can now be collateralized using liquid digital assets, non-substitutable ownership assets (such as Plants/Machineries), mobile-devices-locking technology. This helps to minimize borrowers' risk.

In order to control high lending rates, caused by borrowers'lack of formal credit history, high management cost, etc, lending rates are controlled systematically in a decentralized way using reverse-dutch auctions and transparent bonds risk metadata.

With the mobile apps, and the use of effective credit models, borrowers with no formal credit score can access cost-friendly credit.

Pngme Mobile application provides the opportunity for MFIs and MMNs to sell low-cost credit to their customers. This is as a result of reduced management and loan disbursement costs.

Another problem that Pngme solves is the fact that investors keep seeking high yield investments thereby negatively affecting credit flow in the market. With PNGME, investors are able to access their own exposure to risk and buy bonds that will give them desired returns without having a negative impact on the credits market.

CONCLUSION

Pngme is created and structured in such a way that it provides solutions to the problems of MARKETPLACE LENDING. The Pngme system structure consists of 7 parts, namely:

- User API

- Sidechain API

- Web and Mobile Apps

- Custody & Compliance API

- Credit Scoring API

- Digital bond API

- Digital bond auction API

All these parts and functions work together to make Pngme an effective solution with simplicity.

USEFUL LINKS

Website: https://pngme.com/

Whitepaper: https://docsend.com/view/x4ts5tm

Telegram: https://t.me/pngmecommunity

Twitter: https://twitter.com/pngmemobile

Facebook profile: https://www.facebook.com/pngme

Author

Bitcointalk username: Adaora2323

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2011741;sa=summary