In a previous post, we explored the intrinsic value of Bitcoin determined by the Energy Spent. The conclusion from the original author was that our time is limited and is therefore our most valuable resource. What we choose to put our energy into and therefore our time into, is our most valuable choice. Bitcoin values energy. Just as mass can be represented by energy, so can Bitcoin's Price.

Following on from that, I decided to take a dive into the parallels of the Bitcoin Energy Value with a Steem analogue, namely the Steem 'Energy' Value. After-all, creating content requires time and therefore energy, and with that, we should be able to find an intrinsic value of Steem by modelling the amount of "energy" currently put into the network.

Sophisticated models for how much "Brain Energy" is expended warrants an entire study in itself. There are many ways we could model how much "brain energy" is used when contributing to the network but for this crude initial study, we decided to go with "Daily number of posts" as the "Brain Energy Value" because this on-chain metric is easily obtained.

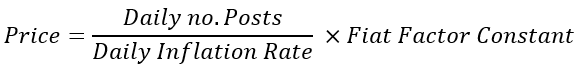

In essence, our initial hypothesis becomes :

Steem's fair value is a function of the Energy input (no. of posts), the inflation of the supply and a constant representing the fiat dollar value of the energy input to the Steem network as represented by "posts"

The formula is as follows :

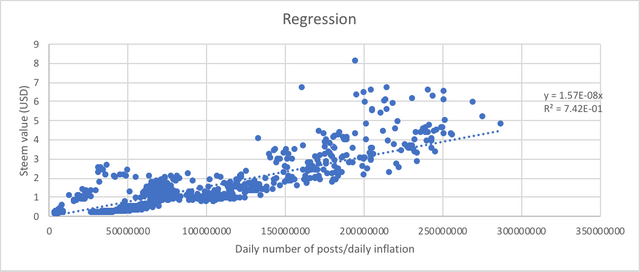

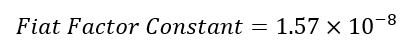

To get the Fiat Factor Constant we plot the Market Steem Price in USD against [Daily no. of posts / Daily Inflation] and perform a regression.

I have chosen the market data starting from 25/11/2016 when the inflation rate was significantly reduced to 9.5% at block 7,000,000.

Plugging the fiat factor constant, daily number of posts and daily inflation rate from the market data, we are able to plot the Steem fair value price against the market value price and find some interesting results :

The result as shown by the plot above, is a pretty good fit. Meaning that the "energy" as represented by "no. of posts" plays a very strong correlation as well as "model" to the price of Steem.

Some Conclusions

In layman's terms, the visual fit of the Steem Energy Value to the Market Price of Steem suggests that the more "Energy" input to the network, the higher value of Steem, and vice versa. No. of daily posts dropping, means a dropping price of Steem and an increasing number of posts mean a rising price of Steem.

Even though we used a crude metric (daily no. of posts) as our energy input, it models the actual market price of Steem very well.

An interesting thought is whether price causes energy to move, or whether energy causes price to move. We haven't got enough data in a full blown crypto bear market to make any sound conclusions but we can see that the market value of Steem is above the fair value of Steem (in our model) for most of the time during bullish phases and the fair value of Steem is above the market price of Steem during the bearish phases.

What is most likely is that, like Bitcoin, Steem appears to exhibit mean reverting behaviour between Market Price and it's Fair Value calculation. That is, they tend towards each other and deviations between them always result in the "gap" being closed.

To compare, I have plotted the Bitcoin Energy value against Bitcoin Price.

A reasonable analogy to the current Steem Price vs Fair Value would be the Bitcoin price in 2014 to 2016.

Bitcoin Price is below the Bitcoin Energy Fair Value, and remains suppressed throughout all of 2015. During this time, the Bitcoin Energy Value begins to level out at a value above the market price. It is not until the Bitcoin Energy Value stops making lower lows, and finds a base that the price is able to eventually catch up to it, and reassert the lead.

Price leads the Bitcoin Energy Value throughout the bull market. Those who valued the Bitcoin network continued to input higher energy and therefore dollar value to mining than the market price during 2015 in expectation of the price catching up and going much higher. These are the strong miners who mined at a "loss" while the remainder of the weak miners are shaken out.

Comparing this to the Steem market value vs Fair Value, we see some similar parallels.

Price led the fair value from mid 2016, all the way to the end of 2017. A higher steem price results in higher potential rewards. Therefore, the energy input (no. of posts) is expected to climb as Steem price does. This is reflected by the fair value price lagging just behind the market price of Steem.

Fair value price has now stayed above market price for about 18 months and is finally looking like a base is being formed. This means that the "miners" of Steem - all the people posting, are now doing so regardless of the price. They are the strong hands who continue to contribute "energy" despite it being rewarded below the fair value.

Some further takeaways for Steem

- The Fair value of Steem can be crudely approximated by the daily no. of posts and therefore Brain Energy Expended.

- The Market Price of Steem and Fair Value of Steem are mean reverting, given enough time, they will cross each other.

- If the fair value forms a base and stays above the market price for a significant amount of time, then it would signal the shaking out of weak participants and conversely, the strengthening of existing participants. In other words, if the no. of posts start to level out (as is possibly the case right now), then the shake out is nearly complete and we can expect the market price to tend towards the fair value price of Steem.

- By studying the long term demand for Steem based on the inflation rate (stock to flow) and the energy input (posts), the Steem Energy Value represents a symbiotic relationship between Steem supply and demand!

What is the fair value price of Steem right now according to our model?

$0.503039

Download the Steem-Value Excel Spreadsheet.

Amazing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting analysis. While "crude" it is a terrific starting point. I think you are spot on when choosing number of posts. Another term for that is activity and that is what parlays into the network effect.

While not exact, it is logical to think substantially more posts requires a great deal more people (nodes) which is the epitome of the network effect.

It will be interesting to watch the correlation you created over the next year or so to see how things change.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @holdo! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit