There have been numerous reports lately about the impact of Covid-19 on the global food supply chain. Food availability and pricing seem to be largely driven by a combination of logistical bottlenecks, countries restricting exports, and panic buying — not just the latter.

The most vulnerable companies are those that rely heavily on input and materials from China and other parts of the world. But these impacts affect almost every retailer, not just food and grocery retailing.

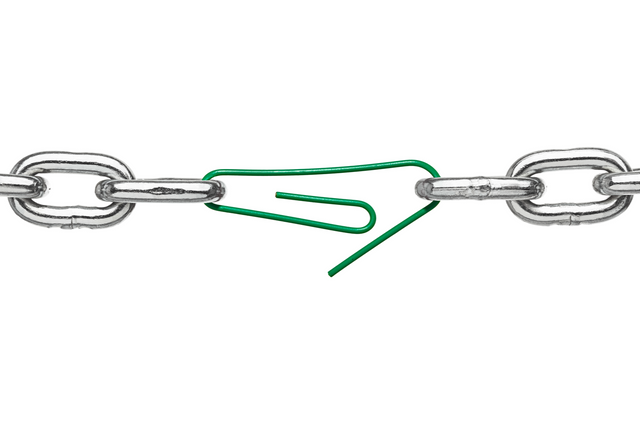

The silver lining of the Covid-19 pandemic for retailers is it provides a valuable opportunity to evaluate and remedy the weak links within their supply chains. There are eight facets that every retailer must pressure test:

- Customer demand: consumption patterns and preferences by market and segment

- Merchandising and pricing: products, pricing, and profitability

- Supplier risk: sourcing options, volume risk, and best price and quality

- Inbound transportation: shipping status, location tracking, and customs management

- Inventory management: hub and spoke stocking, SKU by DC, and returns and damages

- Warehouse management: resource management, and automation and robotics

- Order management: customer visibility to quantity and availability

- Shipment: loading and bundling, driver assignment, and dynamic routing

Based on each retailer’s needs, some of these eight facets will stand out more than others in terms of maturity and importance. However, the most problematic area is supplier risk, particularly with overseas suppliers.

Supplier risk is a misnomer because for most companies it’s too late to mitigate.

Most businesses use a plethora of suppliers — especially in Asia — so, how do we know who’s at risk based on their own supply logistics challenges, geopolitical climate, and changes in trade winds? Many organizations have applied few if any analytics to aid supplier risk identification and business impact assessment. So, there is little to no proactive risk mitigation, leaving companies vulnerable and forced to reactively deal with supply interruptions.

Build capabilities in three areas to turn competitors’ risk into opportunity.

A crisis often presents great opportunities to make adjustments that have long-term business implications. Sometimes these adjustments are necessary for immediate survival. Other times, they’re just smart business moves.

Consider these three:

Identify supply threats. In addition to third party data and analytics tools, there is specialized software that can scan news and media sites, third party and government databases, and competitor sites in real time to gather data points on supply risk. Advanced analytics and machine learning algorithms can be applied to weed out noise and amplify weak signals to highlight risk to your supply chain. Software platforms can map your supply chain network and help visualize potential threats.

Evaluate business impacts. Not all threats require a DEFCON 3 response as companies may have a surplus supply of materials in storage, sufficient unsold inventory, or maybe the greatest impact is to a specific product set that makes up a small portion of revenues. However, it is important to understand the resilience of the product set to the risk. Whether an organization is using sophisticated software or a spreadsheet, an analyst needs to evaluate the impact quickly and with a high level of confidence.

Empower action teams to mitigate the risk. It’s often too late to start planning mitigation when the risk is confirmed. Therefore, create action teams in advance. These teams should be a cross-functional group of managers from operations, marketing, merchandising, sales, pricing, etc. They should meet at least monthly to review supply threats and business impacts, create probability scenarios, and identify specific actions to take if/when certain scenarios manifest. Despite the complexity of supply networks, taking action can be built into the organization’s DNA.

Digitizing supply chain management should be one of retailers highest priorities.

Clearly, the majority of the areas within supplier risk require digitization. But frankly, all of supply chain management in general requires digitization. Customer demand requires third-party data, advanced analytics, and visualization — as does merchandising and pricing. Management of transportation, inventory and warehouses requires sophisticated platforms that securely share data and work seamlessly together.

Smaller retailers often outsource warehouse and transportation. Before these organizations can invest to make sweeping changes across their supply chain management practices, they have to get their own houses in order internally.

For companies that are heavily reliant on suppliers, I recommend building capabilities around supplier management. That means building the right platforms, systems, analytics to go from looking backwards, to being more predictive and looking forward. These capabilities can then be repurposed across other facets of supply chain management.

This article was originally posted on raoanand.com in April 2020.