Introduction

Cryptocurrencies has over the years cause the digital blockchain to developed assets into a vibrant ecosystem of investors, speculators, and traders, exchanging thousands of blockchain assets. Decentralized financial sectors have also tried their best to cause transparency in the field of assets for individuals to have a total control over their assets without any third-party. It is with this that compound which is built on Ethereum seeks to allow its users to earn interest on or borrow cryptographic assets without having to negotiate with a counterparty or peer . Compound is currently ranked 44th on the state of the dapps and 5th on the finance category.

Screenshot from state of the dapps

What is Compound

Compound is a protocol on the Ethereum blockchain that establishes money markets, which are pools of tokens with algorithmically derived interest rates, based on the supply and demand for the token. Users on compound are been classified into two, thus Suppliers and borrowers. On compound these Suppliers and borrowers of assets do communicate directly with the protocol, earning (and paying) a floating interest rate, without having to negotiate terms such as maturity, interest rate, or collateral with a peer or counterparty. Meaning compound allows users to borrow or earn interest on their assets. With compound,each market has a dynamic borrowing interest rate, which floats in real-time as market conditions adjust.

Supplying Tokens

On compound user tokens are not matched and lent to another user but it is been aggregated to users; when a user supplies a token, it becomes a fungible resource, which offers a complete liquidity. Users the other hand are able to withdraw their tokens at any time, without waiting for a specific loan to mature.

On compound, balances in a money market accrue interest based on the supply interest rate unique to that asset. One can also have a view of his balances in real-time. When users make a transaction that updates their balance in supplying, transferring, or withdrawing a token, the interests accrued are converted into principal and paid to them.

Getting Start with Compound

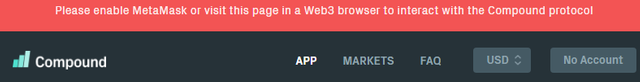

- Log on to https://app.compound.finance/#

- One need to add the metamask extension to his device so as to be able to access the dapp page.

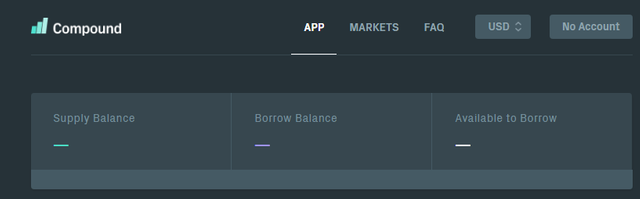

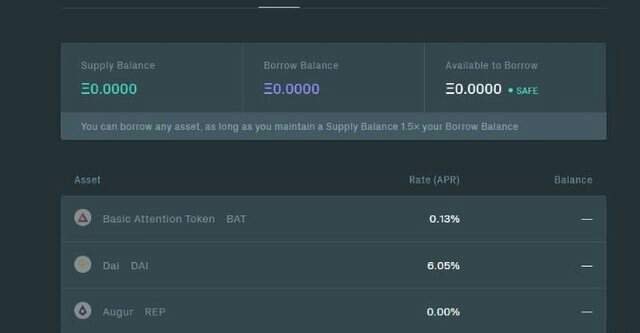

- One will need to enable the asset listed so as to navigate the asset page in other to borrow or supply any of this asset, note that one asset at a time.

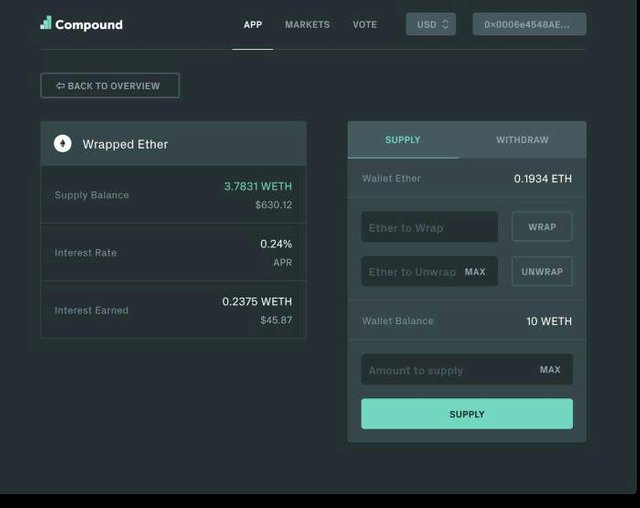

- One can now supply and start earning immediately after submitting the transaction. And as time goes on his interest will be seen.

- One can borrow from compound by submitting the amount he intends to borrow overtime.

One will need to note that there is an origination fee of 0.025%, or 2.5 basis points, for opening a borrowing position. For example, if a user borrows 1 ETH, the actual borrowing position will be for 1.00025 ETH. This very small origination fee prevents spam-like misuse of the protocol.

Also one’s account will monitor the value of his Supply and Borrow positions. Thus, if the value of his Supply Balance declines, or the value of his Borrow Balance increases, such that you no longer have 1.5x collateral, your account will be partially liquidated, to return you to a 1.5x ratio.

What I like About Compound

- It creates properly functioning money markets for Ethereum assets.

- There is always an interest rate on the supply and demand of the underlying asset on each money market.

- Users can supply tokens to a money market to earn interest, without trusting a central party

- Users can borrow a token (to use, sell, or re-lend) by using their balances in the protocol as collateral

What I don’t like about Compound

Compound does not support ethereum directly unless one wrapp it into wreth and unwrapp it back at the point of withdrawal to ether.

Conclusion

Centralized exchanges such as Bitfinex, Poloniex, among others allow customers to trade blockchain assets on margin, with “borrowing markets” built into the exchange. But compound have decentralized system for the frictionless borrowing of Ethereum

tokens without the flaws of existing approaches, enabling proper money markets to function, and creating a safe positive-yield approach to storing assets

My rating for compound will be a 3.5/5 star

All images used are the property of compound.network

Posted using Partiko Android

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by ferrate from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit