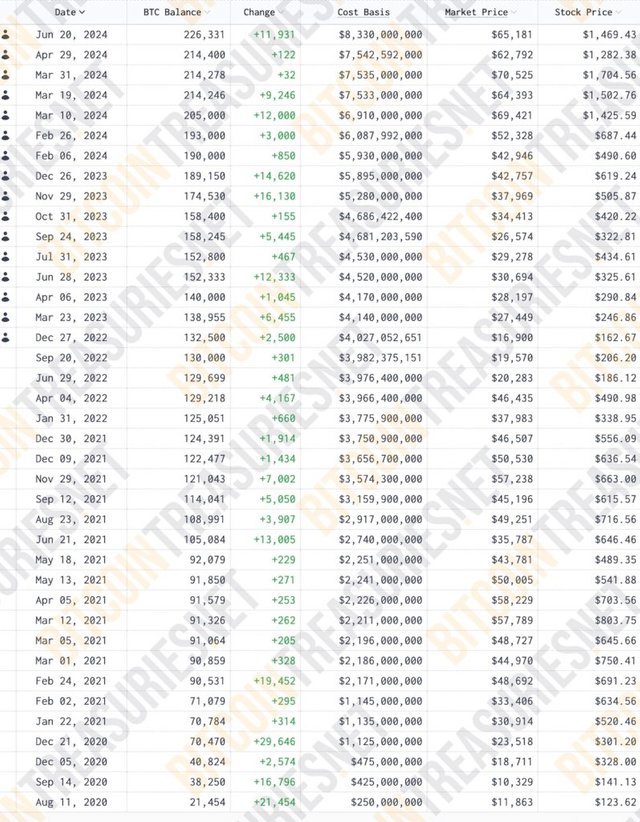

Microstrategy, the largest Bitcoin holding company, said yesterday (20) that it had increased its holdings by another 11,931 Bitcoins (total value: US$786 million), bringing its total holdings to approximately 226,400 Bitcoins.

Microstrategy, the largest Bitcoin holding company among US listed companies, announced on June 13 that it plans to issue convertible bonds worth $500 million due in 2032 through private placement, and will use the funds raised to purchase Bitcoin and company operations.

Microstrategy added another 11,931 BTC

Just last night (20), Microstrategy stated in a newly disclosed document that they had completed the convertible bond issuance on June 18, obtained $786 million in new funds, and had purchased another 11,931 Bitcoins at an average price of $65,883.

This further pushed Microstrategy's current Bitcoin holdings up to about 226,400, with a total value of about $14.7 billion. According to the latest statistics, Microstrategy's investment cost totaled about $8.33 billion, and its current floating profit exceeded $6.4 billion.

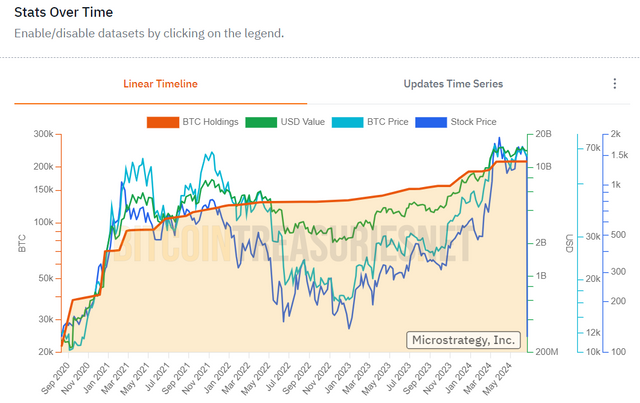

MicroStrategy has been buying BTC since August 2020

Since August 2020, Michael Saylor, the founder of MicroStrategy, announced that he would continue to invest in Bitcoin, and then started a crazy hoarding of coins. Not only did his Bitcoin holdings gradually accumulate a lot of profits, but its stock price also rose accordingly, from $146 in August 2020 to $1,474 now, an increase of more than 900%.

Can you make money by following MicroStrategy to buy Bitcoin?

According to the statistics of bitcointreasuries, MicroStrategy has added positions dozens of times since August 2020.

In the long run (4 years)

If you follow MicroStrategy from the beginning, then based on the current market price of Bitcoin at $65,000, you only bought it three times on June 20, March 31 and March 10 this year, and the lowest purchase price was on September 14, 2020, with an average price of $10,329.

In other words, if you follow MicroStrategy's steps to hoard Bitcoin and hold it until now, you will basically make a lot of money.

In the short term (only looking at the past year)

If the time is shortened, based on the data of the past year. MicroStrategy has made a total of 13 purchases from June 28 last year to the present. Basically, except for the overpriced purchase in March this year (three times of adding positions), other entry times also have substantial profits, and the investment success rate is quite high.

However, after all, MicroStrategy started its layout very early, so the average purchase cost after multiple additions is only about 36,000 US dollars; and assuming that you start buying from the bull market in 2021, you will also suffer a long period of substantial losses.

So if you follow MicroStrategy's footsteps to buy BTC from now on, it may be difficult to make substantial profits in the short term, so investors are advised to DYOR.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit