Hello Steemians! Creating a crypto portfolio from scratch is not easy, here’s how I did it.

I’m documenting my lessons learned as I navigate my way through this new crypto world. How I have gone about building out my portfolio from scratch is the topic of this blog post. I have tried to keep it as simple as possible.

Before we get started on the process, I’d say that the best way to accelerate learning in any new market is always to make sure you have a little bit of skin in the game. Paper trading is good - don’t get me wrong - but I believe it tricks traders into a perception of reality that is not necessarily accurate. Only when your own money is on the line the real trading psychology kicks in - and you would be surprised how different you can react to the market then.

The other thing I’d say before we dive into the process is: make sure to see investing in crypto currencies as part of your wider portfolio of investments, and make sure that money you set aside for it does not make you uncomfortable sleeping at night. It is extremely risky so don’t invest money that you need for rent, food or any other bills!

So, let’s have a look at the process I have followed in building up my portfolio in the crypto space. For every entry into my portfolio I have used three building blocks:

Research

Before you get your feet wet (even for the tiniest of positions) you have to do research. This is KEY! As you enter the crypto world you will find that it is filled with all sorts of exciting, but also confusing, elements. How does the blockchain technology actually work? How do I make a crypto payment? Where do I set up a wallet? Which wallet do I need for which coin? Where is it safe to store my coins? What is an exchange? Is that different from a wallet? What is an ICO? What is the difference between a protocol and a decentralised app? Etc. etc., you get the point. So what I did was I spent quite a bit of time researching the market and I have used these resources to help accelerate the learning and determine the value of a coin:

- White Papers. Every solution / coin / protocol look has one. Although these tend to be quite technical it helps to provide you with a an overview of what the coin / solution / protocol (whatever it is) aims to achieve. This is equally important as how they are doing it. This will give you an idea of the team as well. Have a look and find out who the founders are and the development team is. Are they well known and respected? Have they done this before?

- Youtube. A brilliant source of information. Be careful though, self-proclaimed “gurus” are seeing the world as they are, not necessarily as it is and they are also often incentivised to discuss a certain coin over another. I have typed a blog post about this earlier: https://steemit.com/cryptocurrency/@transptrader/crypto-research-where-do-i-go. Have a look.

- Steemit posts. Why reinvent the wheel? There are so many generous contributors on this forum that have done a lot of research already. Try to leverage off this instead of getting lost in doing your own research with limited understanding.

- Envision the future. Based on the previous steps, do you see this technology take off and work in two years? Five years? Ten?

Watch out

DYOR! Don’t blindly follow ANY recommendation. Follow the process to build your own opinion and thesis on the coin.

Position sizing

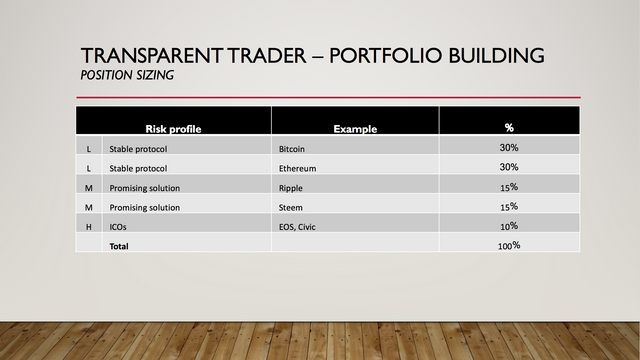

So now that we have made a decision about the value we believe the crypto currency of our choice holds, the next thing to do is determine how much of our hard earned money we are willing to invest into this coin. For me, this comes down to risk management. They way I see it a proven protocol like Bitcoin is less riskier than a promising network like Ripple, which in itself is less risky than an ICO without a proven technology like EOS.

By simply attaching a High, Medium, or Low rating to each of the coins I try to rationalise the position sizing a bit more. Each rating represents a certain percentage of your total investment. I used this as a guideline, but obviously you should determine which percentages you’re comfortable with.

Watch out

- You don't have to commit all your money at once. So say you are willing to put 10% of your funds into a coin but you’re not too sure about the current price, a strategy could be to put 5% in now and save 5% to put in later.

- Don’t consider this to be a static overview. Once you have build a portfolio these percentages will start to move since prices will go up and down. Determine how often you want to re-evaluate the portfolio and try to bring it back in line with what you think it should be.

Entry point

So by now we have decided on a coin, we have determined how much money we’re willing to put into it. And now we WAIT! What I have seen (and I have done this a few times in my trading as well) is that we’re so excited to have chosen a coin and to get involved that we put all the allocated funds in the market straight away. This might not be the wisest decision. Have a look at the Ethereum-USD graph for illustration, it’s easy to see the big swings. Within the span of a month and a half we have had a crazy run up, a significant correction and a slight recovery. Needless to say the point at which you enter impacts your returns greatly.

The difference between buying a dip and buying on the top can be quite significant. So bring out your technical analysis skills and look for historic resistance and support levels and build your thesis as to where you think the price will go next.

Watch Out

- Traditional technical analysis might not cut it all the time. The crypto market can behave extremely irrational and there is often not enough history to adequately assess support and resistance levels. use it as a tool to create a hypothesis. If you’re in for the long term, this is less relevant. If you’re trading shorter term, be willing to cut your losses quickly if needed.

- The exchanges. Where is the coin traded? Is there a lot of volatility or not? This makes it hard /easy to get in/out of positions if required.

Lastly

Store any coin you buy safely! Do not leave any coins on exchanges, unless it cannot be stored anywhere else. And secondly, please note that I’m NOT a financial advisor, this is NOT financial advise. DYOR! DYOR! DYOR!

I hope this post is useful for any new starters in the crypto world. Please let me know your comments or questions! If you liked this post, you might be interested to learn about how I manage to balance trading and life (this is not easy…). I wrote about it here: https://steemit.com/life/@transptrader/how-to-balance-trading-and-life-an-ideal-day-in-the-life-of-a-crypto-trader

All the best,

Jeroen (aka The Transparent Trader)

Great post and definitely a good help for people that want to build a good portfolio :-)

Resteemed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good post. Thanks for sharring

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You’re welcome @mountrock!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Definitely a well-written, much-needed, quite informative post. In March of this year, a person asked me through FB messenger if I was interested in making money with a crypto venture. I had no idea what he was talking about, but being open-minded, I didn't say no. For the next two months and even now, I have been hyper-cramming information into my mind to learn all about this subject. Finally investing in a few ventures, I am already seeing a positive result, even though some of the recent fluctuations cost me money because of timing and deadlines, I am still confident that my overall success is already certain. Thanks for this post. Good job!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @theluckytj and keep up the good work!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey man really liked the post, since im new to investing here.

Also Id like to nominate the post in a curation group im in of you dont mind

This gem of a post was discovered by the OCD Team!

Reply to this comment if you accept, and are willing to let us share your gem of a post! By accepting this, you have a chance to receive extra rewards and one of your photos in this article may be used in our compilation post!

You can follow @ocd – learn more about the project and see other Gems! We strive for transparency.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Too bad I didn't make it @dorman but I still really appreciate the nomination and I am following OCD now as well. Thanks, Jeroen

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes it alays a strong competition, maybe another time.

Great I hope you like our compilations.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @dorman, thanks for the nomination!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good to see guys approaching crypto portfolios with a bit of research and analysis! Guesswork is akin to gambling haha

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit