Topic 1: Why Central Banks Persuing CBDC?

CBDC (Central Bank Digital Currency).

Cash is been used less and less. The central banks around the world are thinking of alternatives like CBDC to inject liquidity and facilitate transactions across borders.

In Sweden the use of cash has reached historical minimums while in USA they still use paper checks to reach with economical aid to the population. In Switzerland, the Swiss National Bank has already an ongoing research project Helvetia (https://www.bis.org/publ/othp35.htm) which tends to go live this year in which CBDC and retail CBDC platforms are being investigated. It is necessary that the project reaches scalability and the governance and compliance is achieved (Anti-Money Laundry_AMT, etc). The Blockchain and the DLT (Distributed Ledger Technology) will allow digitalization of the economy and widen the access to central bank money, optimize and speed-up payments across borders, etc.

For the Euro-Zone, an investigation will start in june this year and it is expected that decisions will be made in 2022. Until now the possible type of systems to be implemented are:

- All centralized by Central Bank

- Hybrid Design System: private sector (private banks) manages the accounts and make the payments and the central banks are back-stop for the system.

- Intermediate architecture: intermediaries report all to the central bank.

The maturity of the country and economy will be significat factors in this transition.

Although digital currency has alreay been stabished in China (eYuan), it is foreseen that the eEuro will be implemented in the next 2 to 5 years, it will not be very soon.

Interesting links:

Digital Euro_Christine Lagarde

Topic 2: Private Sector and its Opportunity to Shape CBDCs

CBDC is not pretending to replace physical cash but it will be a complementary solution. With CBDCs we are not creating new currencies, we are changing the tecnnology. It is not expected that CBDC will negatively impact the inflation rate. If in a country there is real inflation, this will also be reflected in the CBDC. China is already using CBDC and it is planning to use their payment infraestructure with other Asian countries.

In order to prosper with CBDC, it is needed more education to the population and collaboration between all stakeholders.

Topic 3: Crypto Asset Regulation: EU vs USA vs ASIA

Blockchain-related business is not yet regulated in all countries. In Europe, Switzerland has made some steps forward, however in UK, USA and the rest of Europe there is still a lot to be discussed (regulation, compliance, standards, regulations for the different assets like commodities, bonds, etc,). Singapure is also making a good job, there is some jurisdiction and a strong welcome to the industry-securities regulation.

An important point to allow a way forward to digitalization of the economy is the development of a Reliable Digital ID.

Topic 4: CBDCs: Research, Design and Lessons Learned

Speaker: Raphael Auer (Principal Economist, Bank of Intenational Settlements)

As cash is declining in use, central banks have started to talk more positively about CBDCs. In the last 4 years, the CBDC projects in the world have considerably increased. The intention is to create a more resilient and safe payment system.

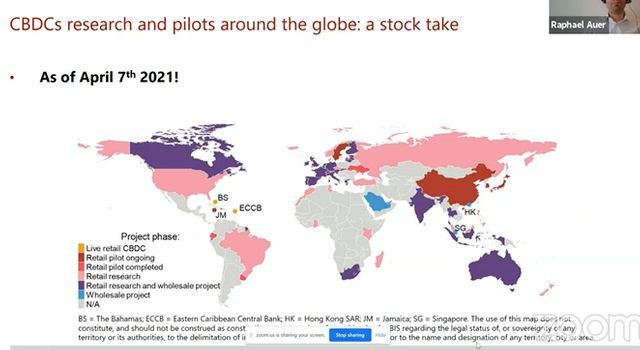

In the below picture it is shown the current status of CBDC research and pilots around the globe:

Source: European Blockchain Convention (Raphael Aure)

In order to design a CBDC, there are a lot of factors to be considered, from the consumer side and from the CBDC design choices:

CBDC Design:

- type of architecture/DLT based or conventional central bank architecture?

- Account or token based access technology?

- Wholesale or retail interlinkages?

Consumer needs:

- Identification (ID)

- Cash-like with peer to peer functionality

- real time payments

- resilient and arobust system

- privacy and lawful exchange

- accessible to all (inclusion)

- cross-border payments

Types and options for the CBDC Design Architecture:

- 1st Concept - direct (all centralized in the Central Bank)-Cash and Retail CBDC will be claimed to the central bank

- 2nd Concept Intermediated CBDC (fully operated by private sector)

- 3er Concept Hybrid CBDC (operated by private sector and central bank back-up)

Source: Inclusive CBDC designs_Rapahel Auer

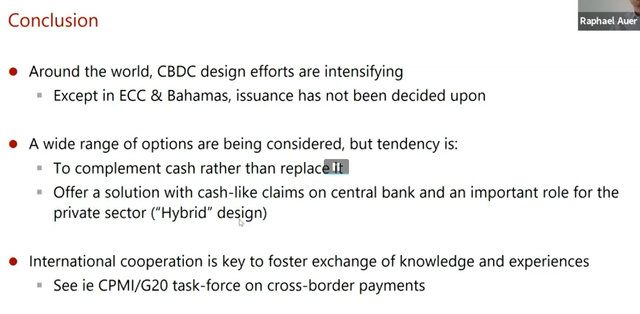

Conclusions:

Source: Raphael Auer_European Blockchain Convention

Topic 5: Workshop with R3: Digital Assets on Corda

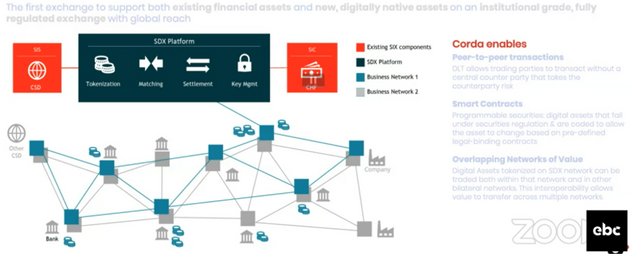

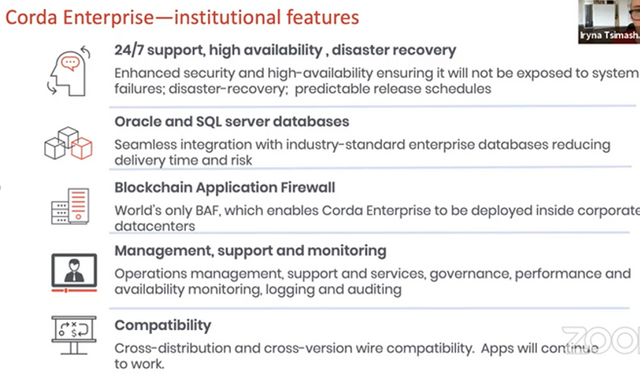

Corda is an open source blockchain platform which allow direct and private transactions. You can read more about Corda and R3.

There is already a wide ecosystem using Corda:

Corda is able to manage tokenized securities, equity, debt or other structures and make transactions by using smart contracts.

With tokens the investors can have a better control of their investments and enables continue trading even offline.

Corda aims:

- Strong Identity_permissioned network

- Privacy

- Consensus

- Performance and Scalability

- Global interoperability

- Open Source & Network

- Notary prevents "double-spends"

- Network MAp (list of network nodes)

- Doorman (permission for nodes to enter the network)

Simplifying the understanding:

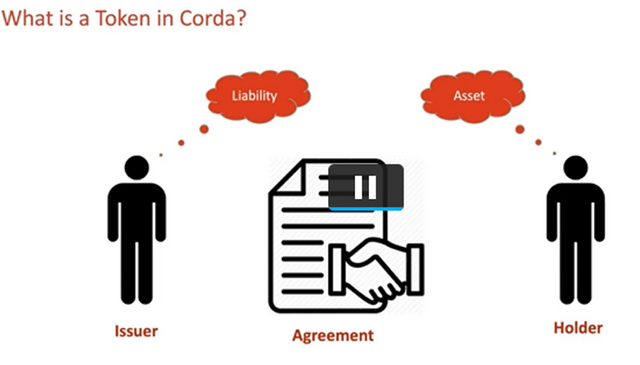

What is a token?

What is a token in Corda?

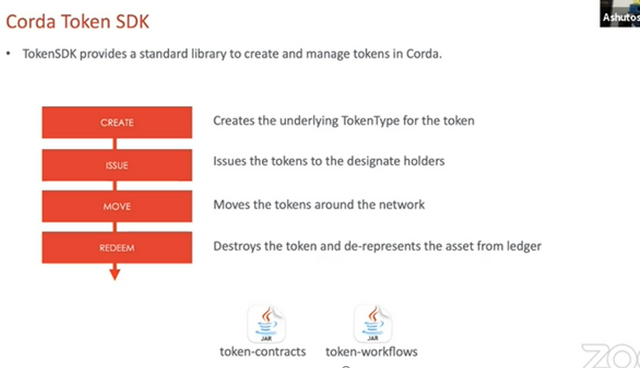

How to create and manage tokens in Corda?

Basically, people will be able to tokenize their assets and trade them via Corda.

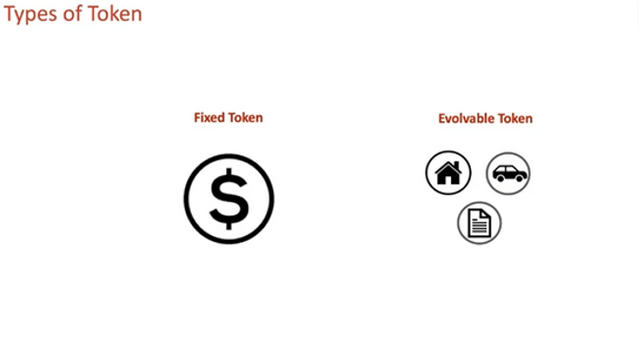

The type of tokens:

- Fixed token (issued by Central Banks)-they dont change with the time

- Evolvable token (house, car, contract)-can change with the time

Source: Corda-European Blockchain Convention

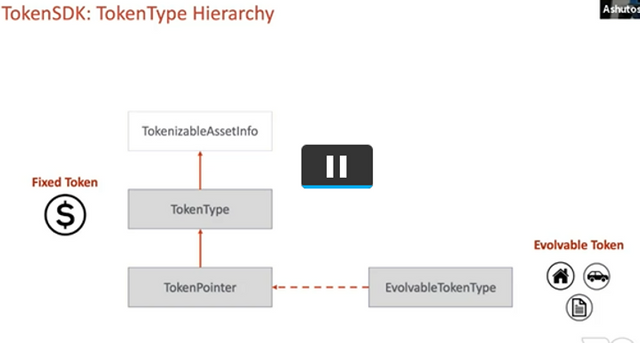

TokenType Hierarchy

Instead of updating the token all the time, there is a TokenPointer that will allow this modification.

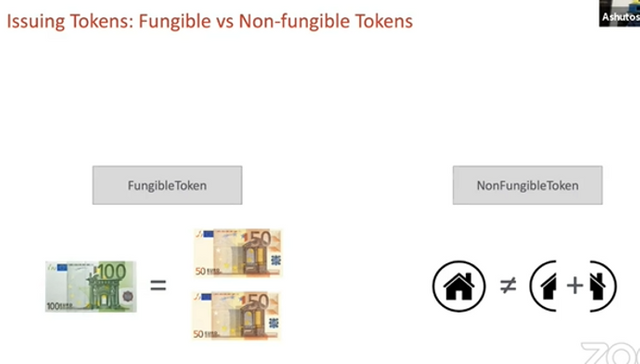

Issuing Tokens: Fungible and Non-fungible tokens

Fungible token are not divisible, non-fungible token enable division:

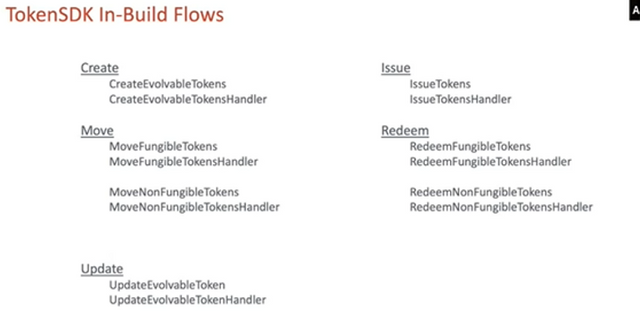

TokenSDK In-build flows

Topic 6: DeFi Building for the Future

There is a considerable amount of money going to DeFi (Decentralized Finance) ecoystems and it is expected to be largely increase in the next 6 months to 1 year.

Institutions are trying to get into DeFi and buying Bitcoin.

The beauty of DeFi is DECENTRALIZATION but it needs education and trust by the users.

It is foreseen that crypto funds investing in DeFi will grow.

See Consensys

Topic 7: Distrikt: the Best of Both Worlds

It is intended that power users will be controlling the data and people can public everything. Distrikt will support the posting of quality content.

See also Introducing Distrikt

Twitter and Distrikt

Topic 8: How can Blockchain Streamline Healthcare and its Paments

Topic 9: Making Europe Fit for the Blockchain, DLT & Crypto Era

There is a growing awareness in Europe about the potential of this technology to be applied in different activities:

- Government administration

- Healthcare

- Finance and BAnks

- Central Bank Digital Currency

- Food traceability

- Fashion (NFTs in games, etc)

- Mobility (cars, car rental, etc)

- Pharma-security, stop retail of fake drugs and medicine

- Logistics

- Art and collectibles

- among others

The EU is discussing the topics, a consent and collaboration within countries and institutions is highly required. A common agreement on the Digital_ID is crucial to implement the new technology: Blockchain/DLT.

@mundo.coach, @meins0815, @inspiracion, @stefano.massari,@mikitaly, @upvotebank, @voinvote, @levoyant, @graceleon, cryptokannon, @riosparada

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

!invest_vote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@meins0815 denkt du hast ein Vote durch @investinthefutur verdient!

@meins0815 thinks you have earned a vote of @investinthefutur !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit